Double-entry accounting #

My system is based on double-entry accounting to track expenses. This is a bookkeeping method used by accountants to keep accounts balanced, particularly for large companies.

To be clear, most accountants will suggest that double-entry accounting is overkill for a home budget. That is why I have automated away most of the complexity, so you don’t have to understand double-entry accounting to use this spreadsheet (thank goodness).

Instead of entering two records for an expense, for instance, you will enter it once, then select a budget category. Behind the scenes, the spreadsheet will track the second entry for you. I’ve done my best to balance usability with robust financial practice.

Technical mumbo jumbo #

If you are familiar with double-entry accounting and want to understand the details with proper technical jargon, here you go:

- Your “budget accounts” are treated as expense accounts

- Your “available funds” are your equity account

- “Uncleared expenses/income” are accounts payable/receivable

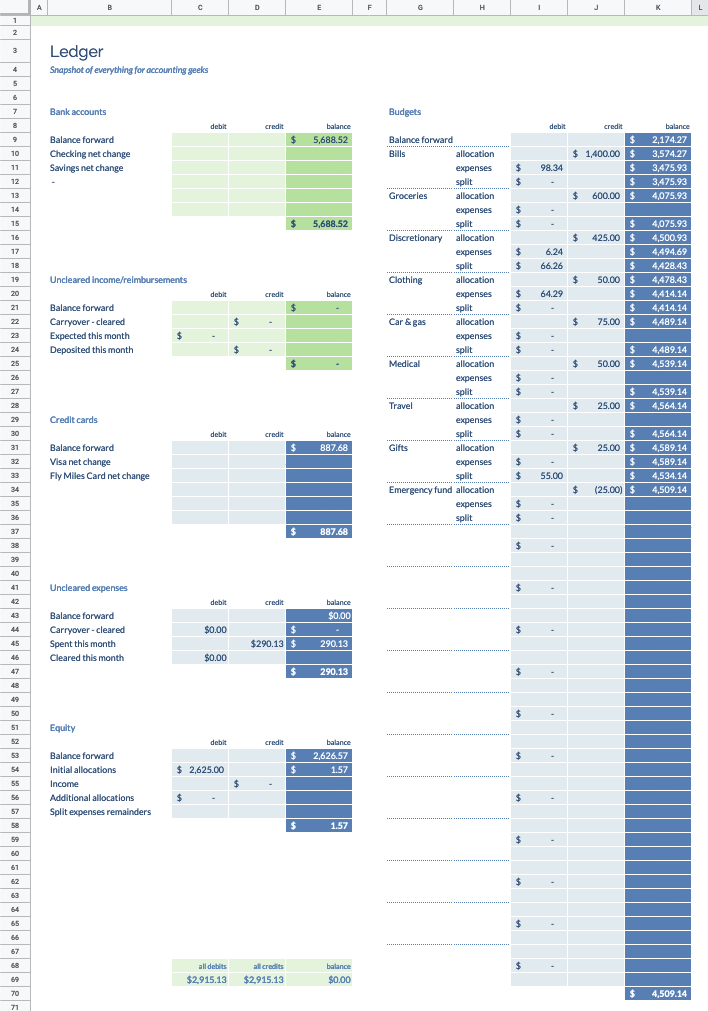

For a full snapshot, look at the Ledger sheet to see how it all works. Again, this is all generated automatically. You don’t have to worry about it — or even fully understand it — when using the spreadsheet.