Weekly balance #

You should periodically check to make sure you’ve entered expenses correctly. It’s possible you forgot to record something, or maybe a bill on auto-pay has gone through. The Weekly balance sheet will help with this.

1. Enter your current account balances #

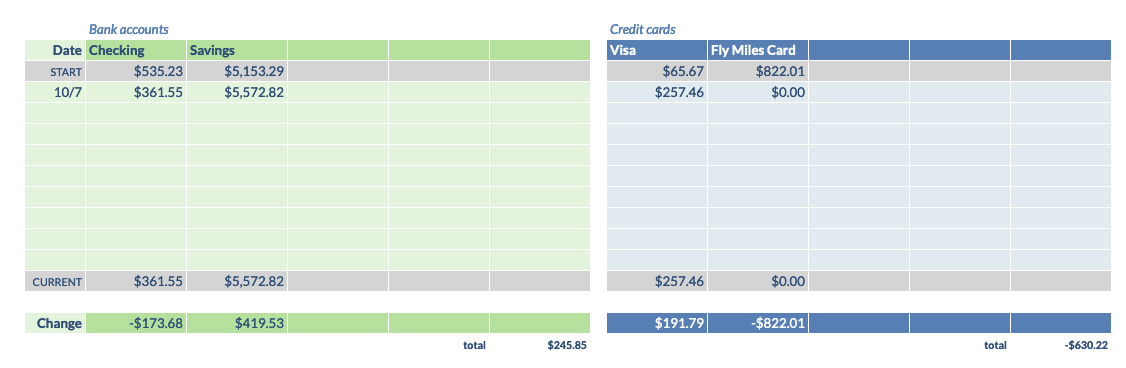

Access your bank account and credit cards online and make note of all the current balances. You should fill in a new row in the bank accounts and credit cards tables of the Weekly balance sheet. Enter the value for every account, even if it hasn’t changed (gaps in the table can cause errors in calculation).

2. Verify expenses and income #

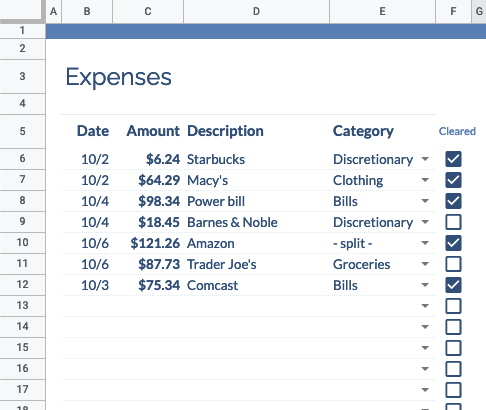

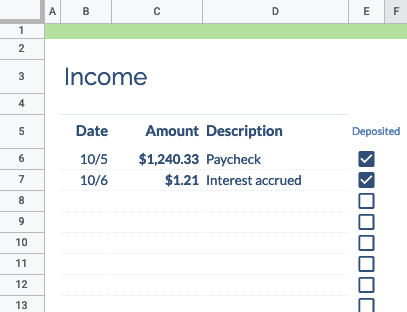

Next, look through the transactions for each account and match them to entries on the Expenses and Income sheets. Verify each amount is correct and, if it has cleared with the bank (no longer “pending”), check the box beside the entry on the spreadsheet.

The checkmarks do two things: they help you find where you left off next time you do a weekly balance, and they will be marked as cleared to confirm your cleared expenses match the change in your account balances.

Record any payments you may have missed. Be sure to mark any income on the Income sheet as well.

3. Confirm that accounts balance #

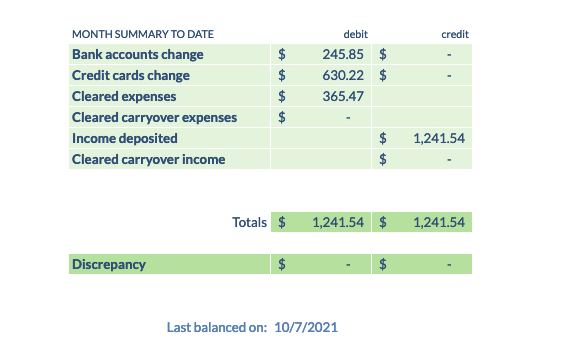

Return to the Weekly balance sheet. The green table on the bottom left shows a summary of changes in your account balances and your cleared expenses/income. If the two totals are equal, you’re done!

Fixing a discrepancy #

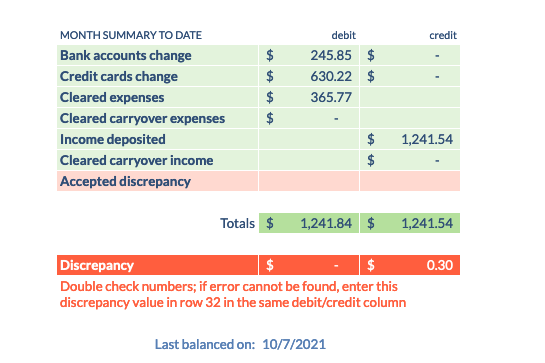

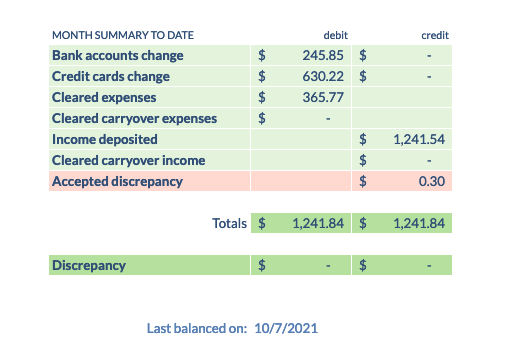

If the amounts don’t balance, the discrepancy amount is shown in orange:

Find and fix the discrepancy if you can. Double-check that your account balances are correctly recorded above. See if the discrepancy matches an expense amount where you forgot to check the “Cleared” box.

If you can’t find the error (or if it’s so small it’s not worth the effort!), you can accept the discrepancy by copying the amount into the “Accepted discrepancy”. This will zero out the mistake so you can start the next week with a clean slate. This will add to or remove from your “Available funds” for next month.

You can update the “Last balanced” date at the bottom with today’s date if you wish. Use this to help keep track of the most recent time you performed a balance.

If it’s the end of the month, continue on to a monthly rollover.