Initial setup #

To get started, you’ll create your own budget template spreadsheet and customize it a little. Then you can use that template to create a fresh monthly spreadsheet for your first month. (Yes, you’ll be creating two spreadsheets to start.)

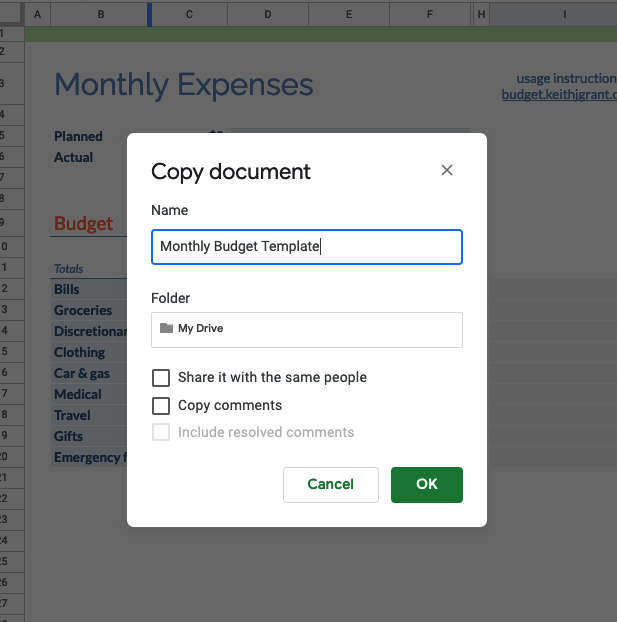

1. Create your personal template #

On the master template, select File > Make a copy. Title your copy “Monthly Budget Template” (or similar).

This will create your personal template, which you will copy afresh each time you start a new budget month. Let’s get it customized the way you need it.

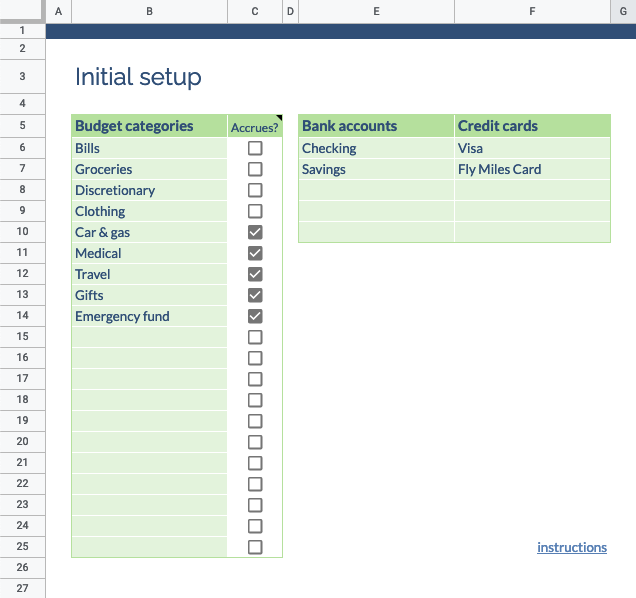

2. Customize your template #

In your Monthly Budget Template, go to the Initial Setup sheet. List your accounts and budget categories in the columns there.

Consider how you want to break up your spending and list those categories in Column B. The spreadsheet has slots for 20 categories, but don’t go overboard as you may find it difficult to split your income too many ways. You can always add (or remove) categories later.

Be sure to create at least one category that’s expected to accrue over multiple months. These are where you can set aside a little money each month to prepare for unexpected or seasonal expenses. (Check the Accrues box beside these categories so they get excluded from your monthly expected vs. spent chart on the Summary sheet.) I also suggest an extra accrual category called “Savings” or “Emergency fund” where you can set aside funds long term.

List your bank accounts and credit cards in Columns E and F (up to 5 each). Don’t worry about listing any investment accounts or anything like that; include just the ones you spend from regularly or deposit paychecks into.

3. Start your first month’s budget sheet #

Now that your template is setup, you can start your first month. Select File > Make a copy. Title this with the current month and year (e.g. “October 2021 Expenses”).

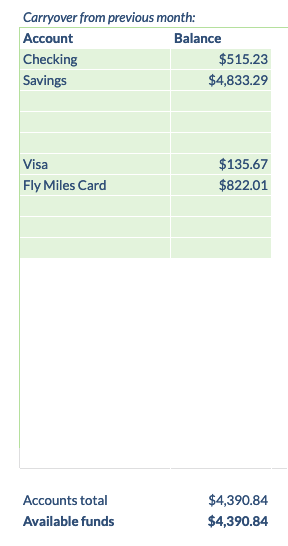

Go to Monthly Rollover sheet. This sheet is designed to help you carry over information from each month’s spreadsheet into the new month. Since this is your first month, you can disregard most of it. You only need to enter your current bank account balances in cells C8–C17.

Notice the accounts total is your bank account balances minus your credit card balances. This is how much you have available for your first budget allocation. Skip ahead to Step 4 of monthly rollover to finish setup.